Planning for catastrophes is important in managing personal funds. Because of its specific qualities, an arbitrage fund may be a helpful addition to a mix of emergency funds. Written from the view of a professional investment planner, this piece explains the benefits of arbitrage mutual funds, how they function, and how to utilize a mutual fund sip calculator to optimize your emergency fund planning.

A Low-Risk Investment Vehicle

Arbitrage funds are hybrid mutual funds with a stock focus that take advantage of price changes between markets. These funds aim to achieve risk-adjusted returns by simultaneously acquiring stocks in the cash market and selling them in the futures market. Arbitrage funds are viewed as low-risk assets in compared to pure equity funds since they reduce exposure to market direction, even if no investment is risk-free.

To offer safety and liquidity, fund managers move investor funds into debt assets like government bonds when markets are less unpredictable. Because of these two benefits, arbitrage funds are a solid option for emergency money and are suited for conservative investors wanting steady, short- to medium-term returns.

Why Choose Arbitrage Funds for Your Emergency Corpus?

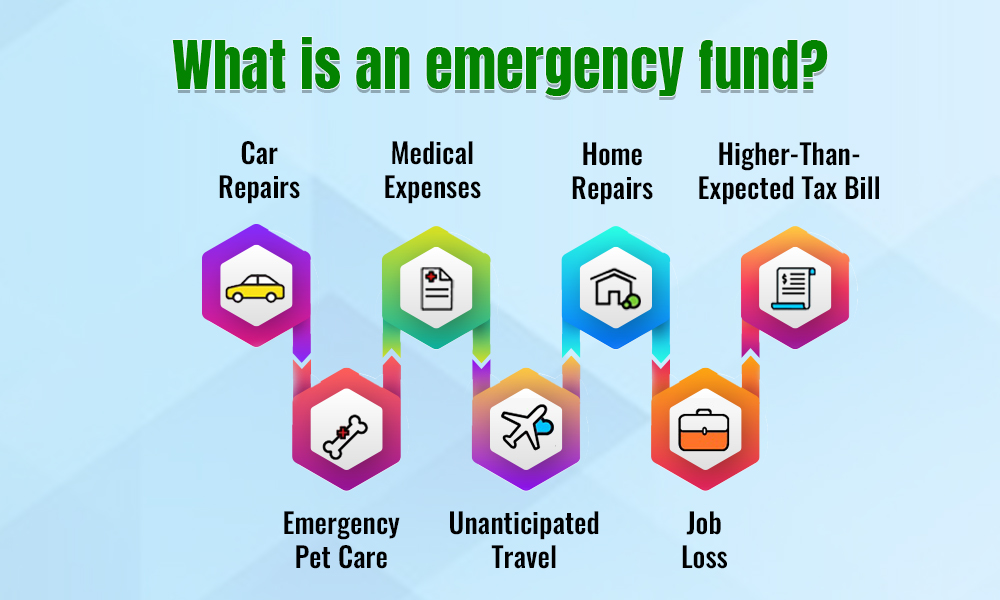

Emergency funds should prioritize safety, liquidity, and reasonable returns. Arbitrage funds fulfill these criteria as they:

- Offer low volatility by hedging equity positions, thus protecting capital from market swings.

- Maintain liquidity, allowing investors to redeem units within a few days, although staying invested for at least three months is advisable to avoid exit loads.

- Provide better tax efficiency: Arbitrage fund is taxed like equity funds, with long-term capital gains (LTCG) taxed at 10% after one year, compared to higher taxes on debt funds.

- Deliver potentially higher returns than traditional savings accounts or fixed deposits, especially in volatile market conditions.

Planning Your Emergency Fund with Mutual Fund SIP Calculator

Systematic Investment Plans (SIPs) offer a methodical technique to gradually building an emergency fund. An excellent online tool for forecasting future returns is the mutual fund sip calculator, which takes into consideration factors such the monthly investment amount, expected rate of return, and investment term.

You may use this calculator to discover how much you must constantly deposit in an arbitrage fund in order to meet your emergency fund goal. To keep your SIP amounts in accordance with your financial goals, it also helps you examine other investing possibilities.

How to Strategically Use Arbitrage Funds in Emergency Planning?

Liquid funds offer ideal liquidity, but arbitrage funds offer higher tax benefits and returns. Combining arbitrage funds with highly liquid debt funds or fixed savings is the best emergency fund strategy:

- Allocate a portion (e.g., 60-70%) of your emergency corpus to arbitrage funds for tax-efficient growth.

- Keep the remaining amount in ultra-liquid instruments for instant access.

- Regularly use a mutual fund sip calculator to track investment growth and adjust contributions as needed.

Risks and Considerations

There are different risks involved with arbitrage funds. Market inefficiencies may cause their returns to change, which would limit arbitrage possibilities in times of market steadiness. Other reasons include bigger expenditure ratios, execution risks, and liquidity limits during times of struggle.

Therefore, before making an investment, buyers should analyze their risk tolerance and emergency fund time frame, even if arbitrage funds give a perfect mix between safety and profits.

Conclusion: Smart Emergency Fund Planning with Arbitrage Funds

Arbitrage funds can boost your emergency fund planning because of their low risk profile, tax efficiency, and acceptable liquidity. You may create a robust emergency account that not only protects your financial future but also grows constantly by combining structured investment plans with strict investing and using the mutual fund sip calculator.

Make reasonable purchases, plan properly, and feel safe knowing that your situations are handled.